Practice Closure Planner & Timetable – Extended Section

Notification of Employees

Written by Philip R. White, B.B.A., LL.B.

If you employ staff (nurses, office manager, receptionists) in your practice, it is wise to notify them before telling anyone else. RSRS always acts in strict confidence, so you can safely contact us to discuss your future closure, but it’s best to tell your staff before patients find out.

If your staff finds out from someone else, it may impact employee morale. The very people you will need the most to assist you as you close your practice may feel compelled to rush out and find new employment. To avoid this, you may want to encourage your staff to remain with the practice throughout the closing process by offering them a retention bonus if they remain until a specified date.

Factors that Impact Length of Notice Period

It is important to determine well in advance of the closure the notice period that you will be required to provide each individual employee of his or her dismissal. Unless the employee has an enforceable termination clause in his or her employment contract the factors that will impact the length of the notice period will include the employee’s age and length of service as well as his or her position and the availability of similar employment. It is an individualized assessment which means that each employee in your office may be entitled to a different notice period.

If you have older, long service employees they may be entitled to significant notice periods. The courts generally consider that upper end of the reasonable notice period warded to dismissed employees to be 24 months. However, in 2016 the Ontario Court of Appeal upheld an award of 26 months’ reasonable notice of dismissal to a pair of supervisors who had worked for their employer for over 30 years and who were in their late 50’s at the time of dismissal. You should also be aware that short service employees are likely to also be entitled to a fairly significant notice period. For example, a 35-year-old nurse with a year or two of service will likely be entitled to a notice period of 3 to 6 months.

Employee Notification Options

When terminating an employee’s employment, you have the option of providing the employee with working notice of dismissal, pay in lieu of notice of dismissal (a.k.a a severance package) or providing the employee with a combination of working notice and pay in lieu of notice of dismissal. If you provide the employee with pay in lieu of notice of dismissal the employee is entitled to be made whole during the notice period. In other words, the employee is entitled to continuation of all benefits and other types of compensation during the notice period or be paid damages for your failure to do so.

Failing to provide an employee with sufficient notice of dismissal puts your corporation at risk of being sued for wrongful dismissal.

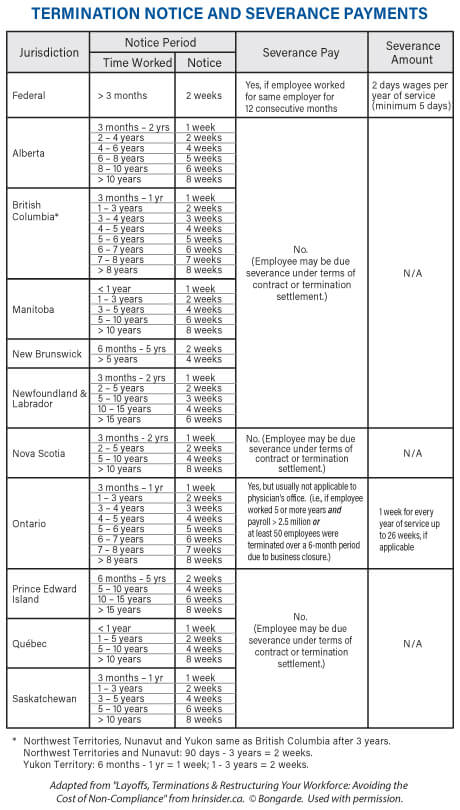

When determining the notice period to be provided to each employee it is also important to take into account the employment legislation in force in the province in which you practice. Most commonly called the Employment Standards Act (“ESA”), each province has legislation that sets out the minimum obligations that an employer owes to it employees. Although the minimum standards in each province differ slightly, the minimum legal requirements for terminating the employment of employees all follow the same basic pattern and are calculated based on the employee’s years of service (see chart). It is mandatory to comply with the ESA. It is also important to understand that because the ESA only sets out minimum amounts your employees likely have a contractual, or common law right, to longer notice periods than that provided by the ESA.

When determining the notice period to be provided to each employee it is also important to take into account the employment legislation in force in the province in which you practice. Most commonly called the Employment Standards Act (“ESA”), each province has legislation that sets out the minimum obligations that an employer owes to it employees. Although the minimum standards in each province differ slightly, the minimum legal requirements for terminating the employment of employees all follow the same basic pattern and are calculated based on the employee’s years of service (see chart). It is mandatory to comply with the ESA. It is also important to understand that because the ESA only sets out minimum amounts your employees likely have a contractual, or common law right, to longer notice periods than that provided by the ESA.

Significantly, if you provide an employee with pay in lieu of reasonable notice of dismissal, any notice period provided in excess of the minimum requirements set out in the ESA will be subject to the employee’s duty to mitigate. A dismissed employee has a legal obligation to take reasonable steps to minimize his or her loss caused by the dismissal by searching for comparable employment elsewhere. Any employment income earned by the employee from other sources during the employee’s period of reasonable notice can be deducted from the amount that your corporation owes to the employee.

Given your employees’ duty to mitigate, it is in your financial interest to assist your employees when the search for new employment. Providing a positive letters of reference as well as contacting other physicians on your employees’ behalf will, hopefully, reduce the financial obligation that you owe to your former employees because it will minimize the period of time that they are unemployed.

When providing an employee with working notice of dismissal it is important that the notice of dismissal provided to the employee be in writing as well as clear and unambiguous. The employee should be provided with a specified end date for his or her employment. Failure to do so may result in a court finding that the employee was not given proper notice of dismissal. When the employee is provided with working notice of dismissal it may be appropriate to also offer the employee a retention bonus if that employee remains with you until the date your practice is closed.

When providing an employee with pay in lieu of reasonable notice you have the option of offering the employee either a lump sum payment or providing the employee with salary continuance for the balance of the notice period. Unless otherwise specified a lump sum payment will not be subject to the duty to mitigate. Salary continuance can be made subject to the duty to mitigate. The salary continuance payments will either be reduced or stopped when and if the employee finds new employment during the notice period.

It is common for employers to offer dismissed employees severance packages that are in excess of that required by the ESA but less than what a court would award the employee as reasonable notice of dismissal. As long as the employee signs an enforceable Release when accepting the severance package he or she will be barred from pursuing a wrongful dismissal claim against your corporation in the future.

Given the significant legal liability that your corporation will face when ending the employment relationship with your staff, the best advice when considering closing your practice is to develop a plan well in advance of any potential closing date. Review your staffing situation with an employment lawyer to understand the specific legal obligations that you owe to each employee and the options available to you when closing your practice. The employment lawyer will also be able to assist you in drafting the termination letters, severance packages and releases necessary to minimize the chance that the termination process will result in wrongful dismissal litigation. If you wait too long to create a plan to end your employment relationship with your employees, the result may be that you incur financial costs that could have been avoided had you acted earlier.

About the Contributor

Philip R. White is a Toronto employment lawyer and the author of www.employmentlaw101.ca. He represents both employers and employees in all areas of employment and labour law. He is a regular contributor to the Employment Bulletin, published by Canada Law Book. He is a practice adviser in employment law for Lexus Nexus Canada, a subscription research website used by law firms. He has spoken at a variety of conferences including on employment law at conferences organized by the Law Society of Upper Canada and the Law Society of British Columbia. To find out more about Phil visit http://employmentlaw101.ca/about-author-toronto-employment-lawyer.

RSRS always acts in strict confidence, so you can safely contact us to discuss your future closure. Call RSRS for guidance notifying employees and determining termination pay. Call 1‑888‑563‑3732, Ext. 2 or visit recordsolutions.ca/consultation.

The material and information provided on this website are for general information only and should not, in any way, be relied on as legal advice or opinion. These materials do not constitute legal advice and do not create a solicitor-client relationship between you and Phil White or RSRS. The author makes no claims, promises or guarantees about the accuracy, completeness, or adequacy of any information linked or referred to or contained in www.RecordSolutions.ca. No person should act or refrain from acting in reliance on any information found on this website without first obtaining appropriate professional advice from a lawyer duly licensed to practice law in the relevant province, state, territory or country.